- #Owner finance amortization schedule how to

- #Owner finance amortization schedule pdf

- #Owner finance amortization schedule verification

- #Owner finance amortization schedule plus

- #Owner finance amortization schedule free

You can get a lower interest rate: It’s uncommon for owner financing to give you a lower rate than a traditional bank loan, but this is possible depending on your loan type.This is because you can avoid many of the costs associated with verifying eligibility for the loan, such as appraisals, flood certification fees, lender underwriting fees, and more. You want to save money for other expenses: Owner financing can have fewer closing costs when compared to getting a loan from a bank.Although this can vary on a case-by-case basis with owner financing, it can still allow you to purchase a property with a smaller down payment than you would otherwise need with traditional financing methods. You don’t have sufficient funds for a down payment: Certain types of loans have minimum down payment requirements.

You can still purchase a property with owner financing if denied a bank loan. This can include things like credit score, income, and asset requirements.

#Owner finance amortization schedule verification

This is because you can skip the requirements usually found with a traditional mortgage loan from a bank, such as verification of credit, income, and other financial documents. You want to finalize the property purchase quickly: Purchasing a property with owner financing can be done much more quickly.This type of financing can also save you money upfront by eliminating many expenses associated with getting a mortgage from a bank, credit union, or other type of traditional lender.īelow are some additional circumstances in which you may find owner financing to be beneficial: When Should a Buyer Consider Owner FinancingĪs a buyer, you might want to consider owner financing if you cannot get a loan from a bank.

#Owner finance amortization schedule how to

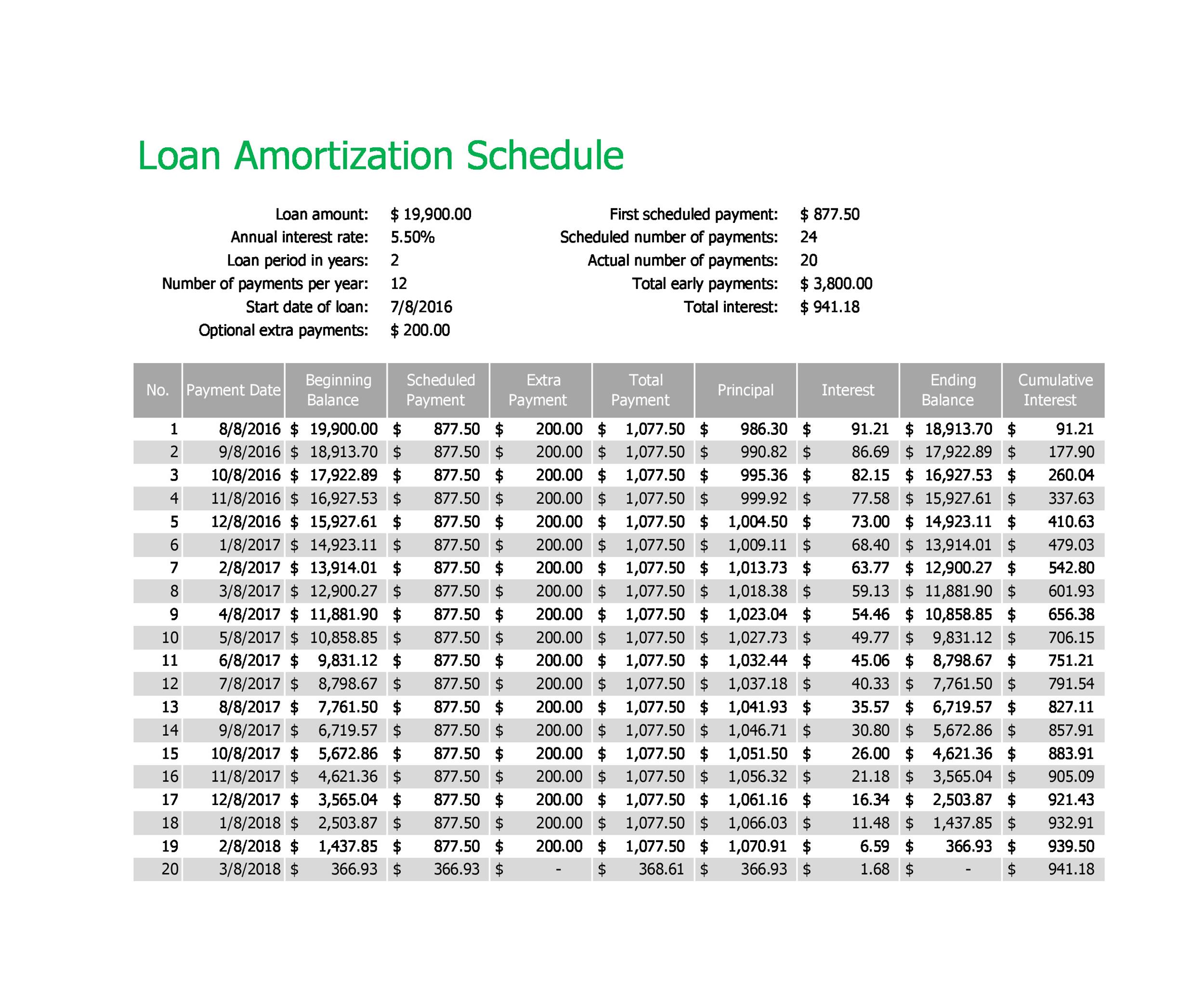

If you’re looking to cut down on costs and get approved at a lower rate from a bank, you can try some of the tips in our guide on how to get a small business loan. The Number of months = 12 x 30 = 360 - convert the number of years to several months.As a buyer, owner financing tends to be more expensive than traditional bank loans. Monthly Interest Rate = 5% = 5/12/100 = 0.004167 - the interest rate has to be divided by 12 to get the monthly interest rate, and divided by 100 to convert percent to decimal. The amortization schedule formula on how to calculate monthly mortgage payments is given below.įor example, to calculate the monthly payments for a 30-year fixed mortgage with an interest rate of 5%, and a principal loan amount of $200,000, we would plugin the above formula with our numbers. How to calculate monthly mortgage payments? Remaining Balance - The remaining balance after deducting the principal payment from the current balance.Īs we can see from the mortgage amortization table above, the principal amount is less than 1/3 of the interest payment in the initial stage.Īs time progresses, the payments between interest and principal start to balance and eventually reverse where the principal payment is larger than the interest payment.

#Owner finance amortization schedule plus

Total Payment - The total monthly payment which is interest plus principal. Principal - The principal payment that would reduce the mortgage balance.

Interest - The interest payment that borrowers need to pay back the lender on a monthly basis with a fixed interest rate. There are four main components of an amortization schedule, interest, principal, total payment, and remaining balance. On a fixed interest loan or a 30-year fixed mortgage, the monthly payment is the same each month, whereas a mortgage with an adjustable rate will see its monthly payments fluctuate from time to time.Ī typical mortgage or loan amortization schedule should show the interest payment, principal payment, total payment, and the remaining balance of the loan for each pay period, usually every month.įollowing is a sample amortization schedule table that shows the amortization chart for a 30-year mortgage with a $350,000 balance and a 5.25% interest rate. As time goes by, the interest and principal payments start to balance and eventually reverse, where the principal amount becomes larger than the interest on each payment. Initially, most monthly payments go to paying interest rather than reducing the principal. The monthly loan payment is determined by the loan amount, interest rate, and terms.

#Owner finance amortization schedule pdf

The monthly amortization schedule is printer friendly, easily exportable to excel, and downloadable as a pdf file.Ī loan or mortgage amortization schedule with fixed monthly payment is a table that shows borrowers their loan payments. You can view the loan amortization schedule with dates annually and monthly.

#Owner finance amortization schedule free

The free amortization table and amortization chart will show you the mortgage payment schedule with all the details about your monthly loan payments, including principal, interest, and loan balance.

0 kommentar(er)

0 kommentar(er)